Key Takeaways for Real Estate Investment Courses:

- The best programs integrate relevant theory with practical application through case studies and guided mentorship provided by working industry professionals like The Land Method.

- Taking courses in real estate investment helps learners understand the concepts, structures, and scope of the industry, enabling them to build a better real estate portfolio.

- Real estate finance, Investment Analysis, valuation, and financial modeling, along with the necessary foundational skills to analyze deals and structure winning transactions.

- The Land Method is an example of targeted land investment training that sheds light on areas that are often neglected in mainstream courses.

Benefits for Real Estate Investors and Professionals

Any individual willing to learn new sources of passive income, such as real estate investment in the United States, is a worthwhile skill to have. These courses are not just basic courses that you would find in online videos or books. These courses are made to equip you with the necessary skills to avoid common mistakes. They also focus on helping you improve your investment portfolio as a real estate professional.

Most real estate evaluations start and hinge on real estate finance, auditing real estate transactions, and debt computing. Understanding how real estate starters think helps with loan structures, such as figuring out the importance of interest and the consequences of leveraging real estate. Being capable of financing a real estate investment is crucial if you are planning on owning one or a few.

Proper real estate valuation is a skill that differentiates complete investors and other real estate business individuals. Many courses can easily teach the real estate market’s Master’s ways that help in property management. These are skills real estate investors should have to find less-valued real estate properties.

A good investor is not about the risk taken, but about the calculation made. Professional real estate courses enhance other foundational courses by aiding in informed decision-making. Students learn to evaluate contracts, the structuring of complicated business agreements, and estimate complications.

Even owning an asset does not mean its value will constantly appreciate, as a property can simply lie dormant, not contributing to value creation. Expenditure optimization tools use models to project revenue streams, which serve as proxies for the value creation potential of the rental assets.

Last but not least, due to the market’s dynamic nature, continued education is crucial for maintaining a competitive edge. It is essential for all professionals, be they brokers, appraisers, or private investors, to understand and appreciate the value creation models to know what is most useful to aid in the value creation process.

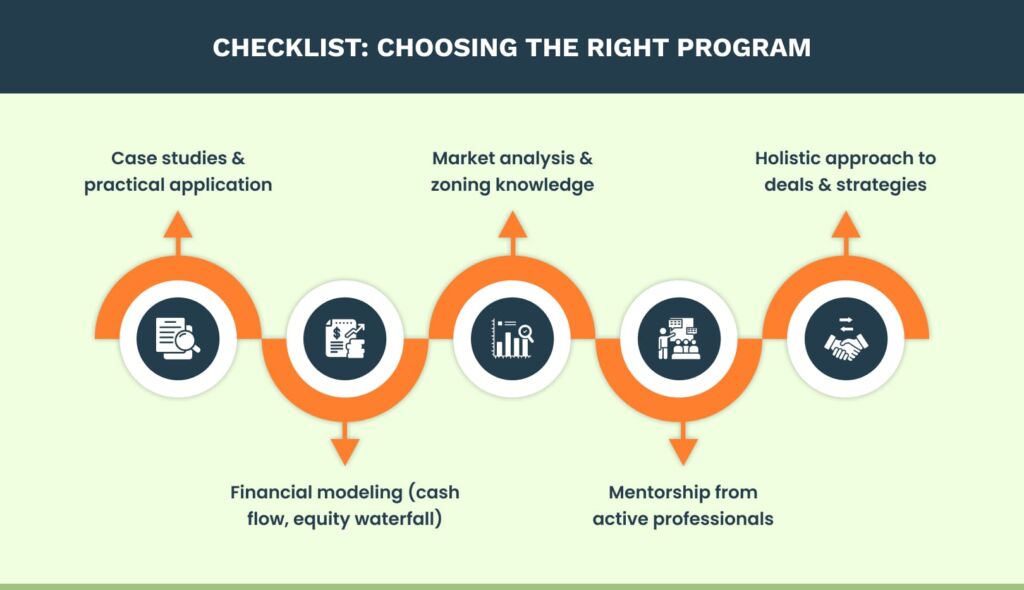

What to Look for in a Real Estate Investment Course

Key Program Features

Not all real estate courses are the same. Picking the best one is a matter of understanding what each feature offers and how it can help your growth. Some courses might be shorter, while some might take months to complete. Program costs vary and can be a factor to consider while opting for a Real Estate Investing Course.

The best courses have up-to-date, real-world use case study program curricula. Learning theories is one thing. Being able to apply financial models to actual deals or analyze a case study on a live property is what matters. They also tend to have a better learning environment than others.

Courses that teach cash flow, real estate financial modeling, and equity waterfall are very useful. These are essential for anyone working on big projects, partnerships, or syndications. They teach profit sharing, investor pay-outs, and how to analyze deal fairness.

Students should also be able to analyze a market and understand the value of property rights and asset management. These help investors learn how to navigate zoning, control operations, and understand the economy’s impact on real estate.

Access to mentorship from brokers, investors, or even vice presidents of real estate firms is also very important. The knowledge and skills gained from mentorship are far more valuable than what is available in books.

The finest courses take a holistic approach to all aspects of investment decisions and strategies of a student’s real estate career. It focuses on all possibilities from recognizing opportunities to executing deals and equips students to operate decisively within a surgically competitive landscape. You will also learn about keeping track of industry trends.

Types of Real Estate Investment Courses Available

The choice of learning pathways these days ensures that learners of all levels and stages of professional development will find something for themselves. You don’t always need a Master’s Degree to be successful.

People from different parts of the world can enroll in online courses and learn about the real estate industry at their own pace. This is possible because the courses have lectures, videos, and assignments that learners can interact with systematically, and forums to socialize with other learners.

Richardson and Chisholm (2004) state that working learners with ample experience may want to invest their time to deepen their usefulness. This is possible with enrollment in tailored certificate programs, which come with employment opportunities.

Many are short and focus on one main thing, termed as workshops. Also, the city’s dwellers can benefit from the structured, focused, and intense schedules of other activities, including purchasing a house and managing the city’s assets and the people’s property.

Practitioners and other professionals hoping to work with large corporations or take on leading positions can seek both undergraduate and postgraduate degrees in real estate. These studies in the city focus in detail on touch and urban development economics.

Investment real estate agents seeking to expand their services and recent secondary education graduates who require minimal experience are readily identified as having little to no experience.

An illustration would be The Land Method, which is focused on teaching land investing, a subject area that many courses fail to cover. By attracting investors willing to work with less competition and higher margins, land investing can serve as a strategic alternative to traditional real estate courses.

Emerging Trends in Real Estate Education and Markets

Industry Focus Areas

Real estate training is adapting to turbulent markets, so curricula in 2026 already reflect current investor dynamics. Continuing and early-career professionals alike are absorbing updated concepts in certified workshops and campus courses.

Classes still highlight the enduring lure of health-care and retail pipelines, notably medical offices and grocery-anchored shopping centers. In each new cycle, instructors stress macro indicators, site-demand signals, and evolving tenant appetites, often employing real-time case studies.

Urban land entitlement retains high currency, especially in oversubscribed markets such as Manhattan. Comprehensive portfolios walk investors through the road map of zoning overlays, community-board timelines, and layered debt and equity stack structures, so graduates no longer treat entitlement as an afterthought.

Changes in trajectory drivers merit equal scrutiny. Hybrid schedules have packed the office-lease funnel, while compressing average-lease severity, and affordability-anchored household formation is coarsely reshaping regional sales and rental markets. Left-leaning curricula enable future sponsors to simulate the next cycle’s revenue capture, rather than relying on past performance.

Two expanded instructional kamers merit mention. Practitioner-focused workshops are examining campus-level excellence, silent tenant engagement, and sustainable food initiatives, while long-standing data platforms and locational analytics line the curricula. With hands-on sandboxes in machine-valued appraisals and geocoding analysis, training guarantees sponsors no longer speculate about technology’s arc; they operate de facto digital playbooks.

The Land Method keeps pace with evolving trends by weaving tech-guided market analytics into its coursework, equipping learners with a contemporary advantage for spotting lucrative land deals.

Making the Most of Your Real Estate Investment Education

Taking a course is where the journey starts. To turn tuition dollars into profits, you must apply your new insights thoughtfully and purposely every day. The most successful students don’t get comfortable with notes and PowerPoints; they routinely translate concepts into real transactions, sniff out the best negotiations, and deal with the risks they’ve learned to quantify.

Continuing education is more than a supplement; it fashions a lens through which you see tomorrow’s deals first. Ongoing classes, study groups, and webinars keep you updated, so when a new zoning policy or lending parameter hits the street, you see the opportunity while the average renter is still yawning. Learning the market’s drumbeat means you’re the one making offers, not fitting proposals to last week’s data.

Remember, the curriculum is the skeleton; it still needs the muscle of daily effort. Network relentlessly to deepen your team of equity partners, inspectors, and property managers. Hold frequent meetings with them to ensure that knowledge is integrated into investment performance, meeting deadline after deadline. Be the one putting the spreadsheet theories to the test, iterating, measuring, and courageously tweaking tactics.

Final Thoughts

Real estate continues to deliver the highest long-term risk-adjusted returns available to most investors. Ongoing study and disciplined execution are your fee-for-entry, not the exclusionary selectivity of late-night billionaire seminars. Combine practical coursework with intentional, repeating practice, and you’ll cultivate the judgment, networks, and decision-making that stand the test of economic cycles.

Regardless of whether you enroll in a traditional degree, pursue a certificate program, or dive deep with a specialized approach like The Land Method, the priority is always the same: put the time and resources into developing yourself first. When you build a solid foundation of skills and knowledge, the pathways to reliable monthly income and property value growth become clearer and much more reachable.

Real Estate Investment FAQs:

Are real estate investment courses worth it?

Absolutely. Unlike free content scattered online, a formal course delivers rigorous training, detailed case studies, and personalized guidance. These elements help you sidestep expensive blunders, refine your judgment, and develop a more resilient investment portfolio.

What skills do you gain from a real estate investment course?

Courses often cover real estate finance, debt structuring, valuation, investment analysis, financial modeling, and deal structuring. You’ll also learn how to optimize rental income, assess risks, and manage assets effectively. They help you improve your real estate investment decisions by implementing an effective business strategy and property analysis.

Who should take a real estate investment course?

The curriculum appeals to everyone from first-time investors to seasoned professionals. Brokers, appraisers, and portfolio managers also find value, keeping their skills sharp and positioning themselves ahead of market shifts.

How can real estate investment courses open doors in New York City’s market?

Investing in New York City real estate is notoriously multifaceted, with its mash-up of zoning restrictions, sky-high demand, and finite footprints. Specialized programs that include urban development and financial modeling classes teach the very zoning intricacies that can trip seasoned pros, help you dissect the numbers behind megaprojects, and show you how to pinpoint deals that still pencil in a tightening market.

What should I look for when choosing a real estate investment course?

Seek programs that are anchored in practical application, featuring case studies from current deals and instructors who are currently working in the field. The best courses also weave in financial modeling, cash flow projections, equity structuring, and market analysis.

What types of real estate investment courses are available?

Options include:

- Asynchronous online courses for flexible, self-paced learning.

- Certificate programs for concentrated skills in a narrow segment.

- Workshops that deliver high-impact, practical training lasting a few days.

- Focused certification training, such as The Land Method, takes your skills from academic to actionable, zeroing in on buying and selling vacant plots.

How do specialized programs like The Land Method differ from traditional courses?

Rather than the usual focus on residential or commercial participants, The Land Method centers on land itself, a sector with thinner competition and potentially healthier profit margins. The program is highly designed into modules and chapters to cover all the topics. It’s led by professionals currently working in the industry.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia