Improved land is a parcel that already has the basics in place, road access, utilities, or grading, so you can move straight to development or resale instead of starting from scratch. It’s where structure meets opportunity, giving investors faster returns with less uncertainty.

At The Land Method, our founders, Ginis Garcia and Jonathan Haveles, have over 30 years combined real estate experience. Even today, they are active land investors with relevant knowledge of current industry scenarios and resources. They’ve built the most comprehensive land program that’s constantly updated with current market data, real zoning examples, and new deal structures based on what’s working in the field right now. Every lesson you watch makes you feel like you have a personal coach.

This isn’t another course that leaves you abruptly with incomplete information or outdated ideas. You get complete, step-by-step guidance from sourcing land and analyzing infrastructure to marketing to closing deals, so you can start working in the business immediately after you start going through the course.

With us, the approach is realistic, not overhyped. You’ll learn what it takes to succeed, how long it actually takes, and how to build consistency in your results. And since everything is done online, you can run your land business from anywhere in the world. Many of our current students operate successfully from outside the U.S., using the same systems and tools we provide.

Whether you’re starting out or expanding your land portfolio, we give you clear direction, current information, and working systems to make real progress in today’s land market.

Key Takeaways:

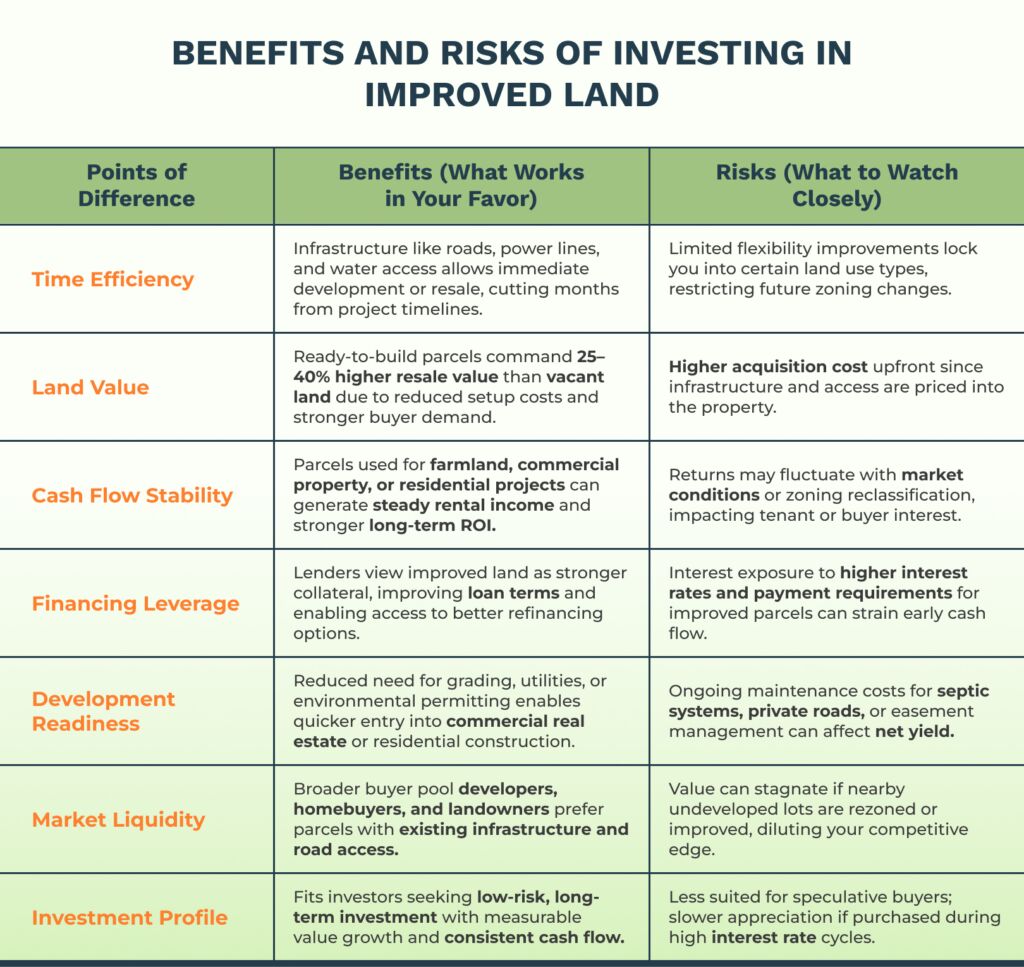

- Improved land with road access, power lines, or utilities offers faster development potential and higher resale value than vacant or undeveloped land.

- The Land Method, led by active investors Ginis Garcia and Jonathan Haveles, teaches data-backed land investment strategies.

- The Land Riches Blueprint provides complete yet step-by-step training to help both first-time and experienced investors understand market demand and handle potential buyers confidently.

- Regular course updates reflect current zoning laws, market shifts, and tax regulations, keeping investors aligned with the current real estate market.

- With a remote-friendly model, investors from anywhere, even outside the U.S., can analyze, purchase, and close profitable land deals.

Understanding Improved Land and Its Key Features

Improved land represents the transition from raw potential to functional value, a concept every land investor must understand before making a deal. At The Land Method, this is one of the first valuation checkpoints taught to help investors distinguish land types and assess true market potential.

- Improved Land: Land enhanced with existing infrastructure, allowing immediate use or resale.

- Undeveloped Land: Stays in its natural state, lacking grading, utilities, or access, lower entry cost but higher improvement expense.

- Vacant Land: Surveyed and subdivided but missing essential infrastructure; serves as a blank canvas for investors planning future development.

- Farmland/Agricultural Land: Developed specifically for agricultural use in rural areas, often with irrigation systems, fencing, and soil conditioning that improve productivity through land improvement and help with long-term value.

Impact on Land Value:

Each improvement, whether road access, utility connection, or septic system installation, significantly increases land value and market readiness. Improved parcels generally yield 40–60% higher resale value compared to undeveloped land and are faster to liquidate.

Types of Improved Land and Their Uses

There are different types of land, each serving a distinct purpose in real estate investment. Understanding these helps investors choose parcels based on the type of land that aligns with their cash flow, risk-taking capacity, land use, investment decisions, risk tolerance, and future development goals.

Residential Properties:

When it comes to improved residential properties with utility hookups, road access, and other basic infrastructure and amenities, it helps investors close the deal sooner. These parcels attract homebuilders and retail buyers, making them ideal for short-term cash flow or quick capital turnover. Unlike vacant land, they require minimal permitting and deliver predictable exit timelines and come with lower risks.

Commercial Property:

Improved commercial property, such as subdivided lots, office pads, or retail parcels, comes with zoning clearance and infrastructure readiness. These sites command premium pricing due to location and zoning flexibility, but require precise due diligence to offset higher loan terms and upfront improvement costs. Investors targeting commercial real estate use these parcels for build-to-suit projects or long-term lease income.

Agricultural and Farmland:

In rural areas, improved farmland includes irrigation, drainage, and access roads that make it cultivation-ready. These parcels perform well in inflationary markets, offering steady rental income from agricultural leases or tenant farming operations. The land’s value is tied less to speculative growth and more to consistent agricultural use, making it one of the most stable long-term investments in the land investment portfolio.

Zoning Regulations and Land Use: The Core of Every Smart Land Investment

Zoning regulations define how each parcel of land can be used, from residential to commercial, industrial, or agricultural, and they play a decisive role in a property’s land value, development potential, and cash flow. For investors, understanding these boundaries is the difference between a smooth project and an expensive setback.

Why does zoning matter to the investors?

A land parcel’s zoning classification determines not just what can be built but how much it’s worth. For instance, a vacant land lot zoned for commercial property near a growing highway corridor will usually carry a higher market value than an undeveloped land parcel restricted to agricultural use. Rezoning opportunities, such as changing from rural residential to mixed-use, can boost future development potential and yield stronger long-term investment returns.

Checklist for what to verify before purchase.

Before closing a land purchase, investors should:

- Confirm zoning designation directly from the county zoning map (avoid third-party listings).

- Review land use restrictions, setback limits, and road access requirements.

- Identify overlay zones like floodplains, wetlands, or protected habitats that can affect construction costs. Basically, figure out the highest and best use.

- Contact the planning or zoning department to ask about rezoning options or nearby land-use plan updates.

- Assess loan terms and property taxes, as both can shift with a zoning change.

Note:

Don’t rely on what the listing says. Zoning laws and data changes frequently; always confirm directly with the county planning department or through the official GIS zoning map.

Making Smart Land Investment Decisions

Investing in improved land demands disciplined evaluation. Each decision should be backed by verified data, not speculation.

1. Verify Access and Utilities

Confirm road access, power, and easement records via official county GIS. Without verified access, resale or development potential drops instantly.

2. Measure the Cost–Time Ratio

Improved land trades 15–20% higher than vacant land, but sells 30–50% faster. Buy where the time saved outweighs the cost premium.

3. Check Real Zoning Data

Use county zoning maps, not listings. Confirm land use and nearby rezoning activity. Transitional parcels often hold the highest upside.

4. Match Financing to Exit

Short-term loans suit flips; long amortization fits farmland or commercial property. Align interest rates and closing costs with your exit window.

5. Use Data, Not Instinct

Cross-check recent sales, tax records, and infrastructure readiness before any purchase agreement. Data-driven buyers protect margins; abrupt decisions or non-data-backed decisions erode them.

The Role of The Land Method in Real Estate Investment

We don’t just provide any outdated course; it’s a working blueprint built by investors who close deals weekly. Every strategy taught inside the program reflects the same process used by them and is practical, data-driven, and replicable.

What makes them stand out? Let’s understand.

1. Systemized Data Sourcing

Students learn to automate county parcel pulls and owner skip tracing, filtering by zoning, acreage, and delinquent taxes. This automation replaces hours of manual searching and increases viable lead flow by over 60%.

2. Precision Valuation, Not Guesswork

Every parcel runs through a fixed valuation matrix that measures access, easements, taxes, and comps before an offer is made. As Jonathan says in Funding with Jay Hinrichs, “Guessing numbers is how you lose deals; benchmarking them is how you scale.”

3. 5-Touch Automated Outreach

The built-in CRM, modeled on GoHighLevel, triggers at least five follow-up sequences via SMS, ringless voicemail, and email, ensuring no potential deal is lost due to poor communication.

4. Coaching from Active Investors

Students see pricing logic, negotiation flow, and closing documentation in action, not in slides.

5. Flexible Execution

Each path is tested, and the course is updated regularly to reflect market shifts.

FAQs

1. Can I invest in U.S. land if I’m based outside the country?

Yes, we offer a remote-friendly system that lets international investors analyze, purchase, and resell U.S. parcels entirely online using verified county data, virtual closings, and trusted title companies.

2. How often are The Land Method’s training modules updated?

The Land Riches Blueprint is reviewed and updated regularly to match current market conditions, zoning updates, and tax laws. For example, in 2025, we updated the system twice, revamped the entire system, and added a ton more content. It is now named Coaching Edition because every module is like you are being coached on what to do. Students always work with the most accurate, real-time frameworks for sourcing and valuing land.

3. Is improved land always a better investment than raw or vacant land?

Not always. Improved land offers quicker usability and lower uncertainty, but comes with higher upfront costs. Vacant or undeveloped land, when bought strategically using The Land Method’s valuation filters, can yield higher margins with more flexible exit strategies.

4. What support do I receive after completing The Land Riches Blueprint?

We offer basic email support for all of our students. We also have a Private Facebook group where you not only get help from Jonathan and Ginis, but also other students who have been in your situation and can help. Students also have access to our YouTube page, where we have a ton of content to help you along the way, and we also do a Crushing Land Series, where we interview other professionals that align with the land business to help you grow your land investing business.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia