If you’ve ever looked at a vacant parcel and wondered whether it’s possible to build on it, the answer is yes, but only if you understand how to work with unimproved land the right way. Many of the most profitable deals we see in today’s market come from vacant, unimproved lots that others overlook simply because they lack some of the basic utilities.

At The Land Method, we work with unimproved and vacant land daily, the kind of parcels most investors overlook because they don’t know where to start.

Our goal is simple: help you understand the numbers, the zoning, and the real market value before you commit.

Here’s what we focus on inside the Land Riches Blueprint: Coaching Edition:

- Zoning clarity — identifying what’s legally buildable and what’s restricted.

- Access verification — confirming road access, utility proximity, and any easement requirements before contract signing.

- Market velocity — evaluating whether the area supports quick resale or long-term appreciation.

- Financing structure — choosing between seller financing, lot loans, or short-term raw land loans based on your exit plan.

Irrespective of whom you plan to sell to, whether to a homebuilder, subdivide for residential development, or hold for long-term equity growth, your success depends on disciplined due diligence and precise cost forecasting from day one.

As urban and suburban land prices continue to rise through 2026, unimproved lots remain one of the most flexible and high-upside opportunities in the land investment market, offering even lucrative returns with low capital investments.

Key Takeaways:

- Unimproved land (often called vacant land) offers low entry costs or relatively lower rates for buying land and offers high prospects of profit-making through the right development plan.

- With fair due diligence, zoning verification, and utility planning, you can build, resell, or hold unimproved parcels for long-term appreciation.

- Financing options, such as raw land loans, lot loans, and seller financing, allow for flexible purchase strategies even with higher interest rates.

- Smart investors in 2026 aren’t buying finished lots; they’re creating value through development, subdivision, or resale after basic improvements.

- Inside The Land Riches Blueprint: Coaching Edition, you’ll learn how to evaluate zoning laws, forecast infrastructure costs, and structure deals that perform in the real market.

What is unimproved land and its characteristics?

Key characteristics include:

- It lacks basic amenities and infrastructure.

- Based on local zoning laws, unimproved lots may qualify for residential development, commercial property use, or agricultural purposes.

- Buyers typically pay less per square foot compared to developed properties, resulting in a lower upfront cost (when development costs are excluded).

- A better resale price can be quoted if the land is developed and equipped with the necessary development.

Common Uses for Unimproved Land

Unimproved land might look like a blank piece of earth, but to a smart investor, it’s potential waiting for direction. Depending on zoning regulations, market demand, and local development trends, these parcels can serve multiple purposes, from residential to recreational.

1. Residential Development

For anyone planning to build single-family homes or custom properties, unimproved lots are a clean slate. You decide the layout, handle the utility setup, and control your costs. Once road access and basic services are added, values can climb fast. Many small developers see 25–40% appreciation before the first foundation is poured.

2. Commercial or Rental Projects

Well-located unimproved parcels, especially near major highways or growing suburbs, can turn into strong commercial real estate opportunities. Once connected to public utilities, they’re ready for small offices, rental units, or mixed-use developments. They’re also more affordable and adaptable than pre-developed commercial property.

3. Rural Investment and Land Banking

Buying early in rural or low-density areas is a classic long game. As infrastructure and housing expand outward, nearby parcels experience significant increases in land value. Holding these for three to seven years can turn modest buys into high-return exits; that’s the essence of smart land banking.

4. Recreational or Agricultural Use

Not every piece of land needs buildings to earn income. Some buyers turn their lots into hunting land, campgrounds, or weekend retreats with minimal work. Others improve soil and add irrigation, converting it into farmland that brings steady rent and lower property taxes under agricultural zoning.

Steps to Take Before You Build on Unimproved Land

1. Verify Legal Boundaries and Access

Start with a professional land survey and title check. Confirm the property lines, recorded easements, and county road access. In 2026, most counties will require GIS-verified access before issuing building permits, especially for vacant land in rural areas. Without legal access, you can’t finance or develop the parcel, no exceptions.

2. Confirm Zoning and Building Code Compatibility

Review local zoning regulations through the planning department. Each county assigns a zoning code R-1 (residential), C-2 (commercial), A-1 (agricultural), etc., that dictates your land use. Cross-check this with your intended development. For instance, a parcel zoned for agriculture cannot host single-family homes or commercial real estate without a rezoning approval. Rezoning requests take anywhere from 45 to 180 days, depending on the county.

3. Evaluate Utility and Septic Feasibility

If public utilities (water, sewer, electricity) aren’t available, budget for private installation. A well and septic system can add $10,000–$30,000, depending on soil conditions and water depth. In some states (like North Carolina and Texas), you’ll also need septic permits before construction approval. Soil tests (percolation tests) determine if your parcel can support a standard or engineered septic system. This is one of the biggest hidden costs in undeveloped land projects.

4. Get Permits and Line Up Financing

Once due diligence checks out, apply for building permits and explore loan options.

- Raw land loans: For parcels without infrastructure, expect higher interest rates (8–10%) and larger down payments (30–50%).

- Lot loans: For partially developed land with road access or utilities, lower down payment (20–30%) and rates around 7–8%.

- Construction-to-permanent loans: Combine land purchase and home construction financing into one loan, ideal for building your dream home.

If traditional lending isn’t feasible, seller financing or Farm Credit programs are common alternatives for unimproved land buyers.

5. Prepare the Site for Development

Once financing is secured, develop the basics: grading, driveway access, and temporary utilities. Counties often require an approved site plan before foundation work begins. Even partial improvements, such as clearing, soil compaction, or drainage installation, can increase land value by 10–20% before vertical construction starts.

How to Finance Your Home on Unimproved Land?

Financing unimproved land requires a proper loan structure and proof of feasibility. Here’s how to do it efficiently in 2026.

1. Pick the Right Loan Type

- Raw Land Loans – Used for completely undeveloped land with no utilities or road access. High risk means 30–50% down and 8–10% interest rates. Best for long-term holding or raw land development.

- Lot Loans – For parcels with basic infrastructure or zoning approval. Down payments typically average 20–30%, with interest rates ranging from 7–8%. Ideal if you plan to build within a year.

- Construction-to-Permanent Loans – Combine land purchase and home construction into one loan. It transitions into a mortgage post-completion, cutting extra closing costs and simplifying the financing process.

2. Use Alternative Financing

- Seller Financing – The simplest route for many land buyers. Expect 10–20% down and monthly payments negotiated directly with the landowner.

- Joint Venture/Partner – Raise capital and pay them a %. Example: they provide the capital, you do the work, and pay them 15% on their money. Partner with another investor and split the profits. Example: they provide the money, you do the work, and split profits 50/50.

- Private or Self-Directed IRA Funding – Increasingly popular among real estate investors, financing unimproved land for future residential development.

3. Strengthen Your Application

Provide a clear site plan, land survey, and proof of zoning compatibility. Lenders prioritize parcels with defined road access, public sewer or a feasible septic system, and clear property lines. Expect closing costs around 3–5% and plan reserves for early-stage construction costs like grading or temporary utilities.

4. Match Loan to Strategy

- Flipping? Go short-term with interest-only raw land loans or seller financing.

- Building your dream home? Choose construction-to-permanent for stable conversion and lower long-term costs.

- Holding for appreciation? Long-term Farm Credit loans or private financing keep monthly payments predictable and flexible.

Challenges of Building on Unimproved Land

A blank canvas, full control, and no builder restrictions! But behind the opportunity are a few realities investors and home builders must plan for early.

1. Hidden Infrastructure Costs

The biggest surprise for most buyers is the cost of adding basic infrastructure.

2. Zoning and Land Use Hurdles

Not every piece of land is ready for your dream home or business project. Zoning regulations define how a property can be used, and they vary widely by county. A parcel listed as “residential” may still have restrictions that prevent multi-unit development, while commercial property zones might require environmental assessments before any grading or building.

Always check with the local planning department before drafting building plans or incurring engineering costs.

3. The Approval Waiting Game

Paperwork can be just as expensive as dirt. Obtaining building permits, septic system approvals, or utility hookups can take weeks or even months if your property is located in a rural area or a historic district. Missing boundary data from an old land survey can send you right back to the start of the process.

4. Financing Isn’t Always Straightforward

Lenders treat unimproved land differently from developed lots. Expect higher interest rates, larger down payments, and shorter loan terms unless you have a clear development plan. Most banks require a site layout, zoning confirmation, and proof of basic access before approving a land or construction loan. Having those details ready makes a big difference in getting good financing options.

5. Managing Construction Uncertainty

Even with the best planning, construction costs move fast. Soil issues, foundation grading, or an updated building code can easily push your project 15–20% over budget. Material and labor costs in 2026 remain volatile, so it’s smart to keep a contingency fund of at least 10% of your total project cost just for the unexpected.

We recommend:

The most successful real estate investors working with unimproved land in 2026 are those who plan for setbacks before they start. They verify every permit, utility, and zoning regulation before breaking ground, not after.

How to Find the Perfect Piece of Land

Finding the right unimproved land isn’t about luck; it’s about checking what others skip. A smart investor looks past glossy listings and digs into the details that decide profit or regret.

1. Don’t Trust the Listing – Verify Everything

Most “ready-to-build” claims are half true. Use the county GIS map to confirm road access, zoning, and utility proximity.

If access isn’t on a county road, expect $8,000–$20,000 in easement or grading costs; factor that in before you commit.

2. Buy Where Land Moves, Not Where It’s Cheap

Low price doesn’t mean good value. Focus on areas with steady turnover where lots actually sell. In 2026, secondary counties near metro zones (like Rutherford County, NC, or Klamath County, OR) continue to show solid growth without city-level prices.

3. Confirm What You Can Build- In Writing

Before closing, get written confirmation from the planning department on zoning and building codes.

A parcel zoned “residential” doesn’t always mean buildable setbacks, lot size, or frontage rules can block permits fast.

4. Test Before You Buy

If you are buying outright, spend a few hundred on a soil or percolation test to confirm septic feasibility If a property is in an area where septic is needed. It’s better than discovering later that your “dream lot” needs a $20,000 engineered system. Avoid steep slopes or heavy clay soils; they complicate foundations and construction costs.

5. Negotiate With Data, Not Emotion

After you’ve done your due diligence, use the numbers to your advantage.

If the property lacks utilities, legal access, or permits, use those costs to negotiate. Most landowners respect informed buyers and may offer seller financing or flexible payment terms to close faster.

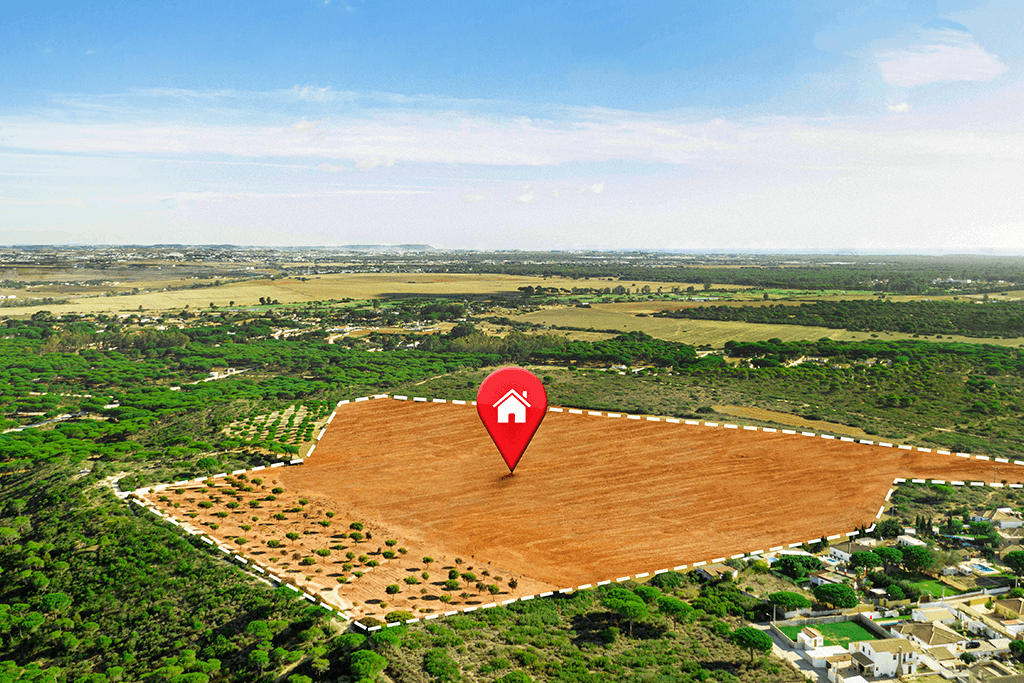

I need a similar example here, and it can go as a content image or with a real image (only if possible)

Example from Experience:

One of our students recently evaluated a 5-acre unimproved parcel in central Florida listed at $42,000. After verifying no existing road access and $18,000 in projected infrastructure costs, she negotiated the price down to $22,000 and closed using seller financing. She’ll resell it in under a year once improvements are complete. That’s how you buy smart, not fast.

The Smart Way to Approach Unimproved Land in 2026

Unimproved land is untapped leverage.

If you know how to assess zoning, access, and utility feasibility, you can turn a raw parcel into a long-term appreciating asset without paying for someone else’s improvements.

The smartest investors in 2026 aren’t chasing finished lots; they’re creating them.

With proper due diligence, realistic budgeting, and the right financing structure, unimproved land becomes a controllable path to cash flow, capital gains, and portfolio growth.

We teach this process from the ground up, literally helping you evaluate buildability, structure the deal, and plan exits that actually perform in today’s market.

FAQs

1. What’s the biggest advantage of unimproved land?

Lower entry costs and full control. You decide how and when to develop, which allows better margins than buying pre-improved property.

2. How do I confirm if a parcel is buildable?

Pull county zoning maps, confirm road access, and request a utility feasibility report. Never rely on listing descriptions; Call the county planning department.

3. What financing options work best for unimproved land?

Start with raw land loans or lot loans. When improvements begin, convert to a new construction loan or seller financing for better flexibility and lower upfront costs.

4. What are the biggest hidden costs?

Utility extensions, septic installation, and permit fees. Always factor these in before calculating ROI many buyers underestimate infrastructure costs by 25–30%.5. Is unimproved land a safe investment in 2026?

Yes, if you’re patient and data-driven. Focus on parcels near infrastructure growth or zoning transitions, that’s where land value compounds fastest.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia