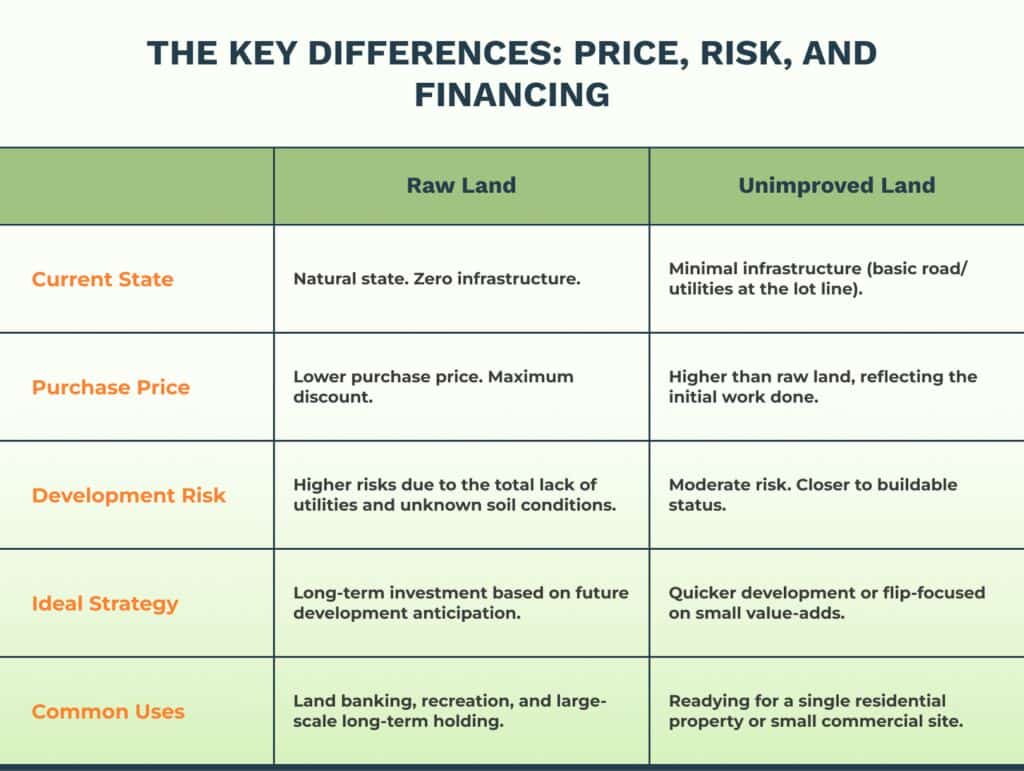

Raw land is the purest form of land you can buy, while Unimproved land sits in the middle: it’s not developed, but it’s not untouched either. When real estate investors talk about vacant land, they often lump everything together. Big mistake. At The Land Method, we know that differentiating between raw land vs unimproved land isn’t just semantics; it’s the difference between a high-profit deal and a money pit.

Our proven investment strategy for buying land hinges on understanding what exactly you’re purchasing. Many potential buyers miss the key differences, leading them to miscalculate costs and financing options.

We cut through the confusion. This guide is dedicated to helping you accurately identify, value, and finance these two distinct types of property, enabling you to make informed investment decisions that align with your financial objectives.

Defining Your Canvas: Raw Land and Unimproved Land Explained

The terms may sound similar, but their implications for the development process are vastly different. Understanding this distinction is the bedrock of intelligent Land Ownership.

What Is Raw Land?

Raw land is the purest form of land you can buy.

- The Natural State: It is entirely in its natural state, completely untouched by any major human endeavor. We call it the blank canvas because you are starting from zero.

- Zero Infrastructure: It lacks absolutely everything: no official road access, no running water, no sewer systems, and no power or gas lines. There is no existing infrastructure whatsoever.

- Where to Find It: This type of property is predominantly found in vast rural areas, far outside metropolitan centers in the United States.

- The Land Method Takeaway: Raw land comes with a lower purchase price but carries the higher risks related to development feasibility. This is where the biggest profits are found, but only if you know how to analyze the market’s future development plans.

Understanding Unimproved Land: The Partially Prepped Asset

Unimproved land sits in the middle: it’s not developed, but it’s not untouched either.

- Minimal Infrastructure: It may have basic, minimal existing infrastructure. Think of a simple dirt access road, some basic grading, or utility lines already run to the edge of the piece of land. Crucially, it has no existing structures.

- Location Advantage: This type of land is often located closer to urban areas or existing subdivisions, making it easier and faster to secure the necessary permits.

- Development Potential: It’s a great stepping stone for development projects, like a custom home or small commercial building. While it still requires significant investment, you skip some of the initial, complex hurdles involved in developing raw land.

Strategies & Opportunity: Matching the Land to Your Goals

Both parcels of land are excellent investment opportunities, but your approach must be customized.

Maximizing Raw Land Investment Potential

When you invest in raw land, you are betting on future development and market trends.

- Targeting Growth: Look for rural areas poised for growth in the United States. We are referring to locations near planned highway expansions, new schools, or areas where county officials are considering zoning changes for residential growth.

- Profit Driver: You lock in the lowest price today, and your value increases as the city’s infrastructure improves. This creates phenomenal appreciation potential. The lack of existing structures makes the acquisition simple.

- NOTE: This strategy often involves a holding period or selling with financing. These types of properties are much more difficult to get “traditional buyers” interested in because they have limited current opportunities.

Leveraging Unimproved Land for Quicker Returns

Unimproved land is ideal if your goal is a faster value-add project.

- Value-Add Focus: Because you already have minimal road access or basic utilities nearby, you focus on high-impact, low-cost improvements. This may include ensuring the land passes a percolation test for septic systems or obtaining the necessary permits.

- Smooth Development: This streamlines the development process for builders. This is why this type of property is preferred for rapid development projects that can be quickly converted into residential properties.

- NOTE: These types of properties offer more options for immediate resale, whether by a double closing or selling with financing, due to their ability for immediate development.

Critical Due Diligence for Informed Investment Decisions

Whether you are buying land in the natural state or a partially prepped land parcel, the due diligence process remains non-negotiable.

Key Considerations for Buyers: Before You Close

Don’t guess, verify. This protects you from catastrophic mistakes when developing raw land.

- Local Zoning Laws: Confirm local zoning laws and building codes with the county planning office. What exactly is the permitted use (e.g., agricultural, multi-family, commercial land)?

- Utility & Access Check: For raw land, get quotes for bringing in essential services and verify legal road access. For unimproved land, confirm the capacity of the existing infrastructure.

- Environmental Concerns: Identify any flood risks, wetlands, or environmental concerns that would spike maintenance costs or render the land unusable.

Making the Right Decision for Your Goals

Ultimately, the best investment decision depends on your resources and patience. The smart real estate investors match the land to their desired outcome.

- If you have time and want to capture maximum long-term upside, consider investing in raw land.

- If you want faster sale opportunities due to immediate development potential and lower upfront effort, choose unimproved land.

At The Land Method, we eliminate the guesswork. We provide our students with a repeatable system to analyze the key differences, evaluate development plans, and confidently move forward in the US real estate market.

FAQs

1. Is raw land truly a “blank canvas,” or does it have hidden problems I need to worry about? It is a blank canvas, but that doesn’t mean it’s risk-free. The biggest “hidden problem” is a lack of verified infrastructure. You need to analyze the soil (for septic feasibility), legal access, and utility distance. We teach investors to assume zero infrastructure exists until they verify it directly with the county.

2. Which is easier to finance: raw land or unimproved land? Neither is easy because traditional banks view both as speculative. Unimproved land might have slightly better bank options due to its closer proximity to utilities, but both often require specialized raw land loans with high down payments. That’s why we heavily focus on offering seller financing, which bypasses the bank altogether, making funding much simpler regardless of the land’s current state.

3. I found a cheap lot. If it has a dirt road leading to it, is it considered “unimproved”? Maybe, but don’t count on it. The key isn’t the road’s material; it’s whether that dirt road is a legally recorded, public, or deeded access road. If it’s just a path on a neighbor’s property, you may have no legal access, and it should be valued as high-risk raw land. Always verify access with the county.

4. If raw land is cheaper, why wouldn’t I always choose it over unimproved land? You choose unimproved land when you prioritize sale speed and lower development effort. While raw land is cheaper upfront, the cost and time required for infrastructure development (e.g., bringing in power and installing sewer systems) can be massive and unpredictable. Even if you are waiting on someone else to do this, it will take time. If your investment strategy requires a quick flip or development, unimproved land minimizes that execution risk.

5. How does The Land Method help me avoid misidentifying a piece of land and miscalculating my budget? We provide a structured due diligence system. Instead of relying on a vague listing, we provide you with a checklist and resources to verify three key aspects: proper legal access, confirmed utility feasibility, and official county zoning. This process ensures you never mistake a high-risk raw parcel for a ready-to-build lot.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.