As we move into 2026, you will notice that most investment statistics in the US suggest land investing is slowly yet consistently picking up. While traditional investment options like stocks, the S&P 500, or mixed stock‑and‑debt portfolios often deliver slower or inconsistent returns, land investing continues to stand out as a more predictable, asset‑backed approach with stronger short‑term and long‑term potential.

At The Land Method, we’ve seen this shift firsthand. With more than fifteen years in the business, we’ve watched investors move away from purely speculative markets and toward assets tied to real estate values and tangible growth. Both of our founders, Jonathan Haveles and Ginis Garcia, remain active land investors themselves. Their real‑world experience shapes every part of our training, giving new and seasoned investors an inside look into today’s land investing landscape and where the real opportunities are emerging.

Through step‑by‑step instruction, real deal reviews, and the same acquisition systems our founders use daily, The Land Method shows investors exactly how to identify profitable land parcels, complete proper due diligence, and build a stable, predictable investment portfolio, even as the 2026 market evolves.

Why Land Investing Is a Strong Investment Opportunity in 2026?

Land investing in 2026 is being driven by fundamentals, not hype. Rising interest rates, tighter lending standards, and affordability pressure in the housing market have slowed speculative building, but they have increased demand for well‑located land. Unlike improved properties, land carries no depreciation, no tenant risk, and far fewer variables tied to operating costs.

What makes land a good investment right now is control. Investors can lock in land at today’s market value while development, population growth, and infrastructure expansion play out over time. With land loans remaining conservative and fewer institutional buyers competing at the lower end, individual land investors still have room to negotiate favorable terms and structure long‑term upside.

In a 2026 environment where volatility continues across the stock market and exchange‑traded funds, land investing offers a simpler investment vehicle, one tied to real estate values, limited supply, and predictable demand rather than short‑term market sentiment.

Why Land Investing Remains a Strong Opportunity in 2026?

Rising interest rates, tighter lending, and market volatility have made leveraged assets harder to manage, while land continues to trade based on location, access, and long-term demand.

Unlike houses, land ownership does not involve renovation risk, tenant management, or unpredictable repair cycles, making it a cleaner land investment for investors focused on capital preservation and long‑term growth.

- Land is a finite resource, and limited supply is becoming more visible as zoning regulations and land‑use restrictions tighten.

- Land value is driven by location, road access, water rights, and development plans, not by short‑term market noise.

- Vacant and raw land requires less ongoing involvement than residential or commercial real estate.

- Carrying costs are easier to forecast, with fewer variables beyond property taxes and basic holding costs.

- Rural land near population growth corridors offers measurable investment potential without exposure to housing market volatility.

- For land investors, this asset class functions as a long‑term investment vehicle rather than a speculative trade.

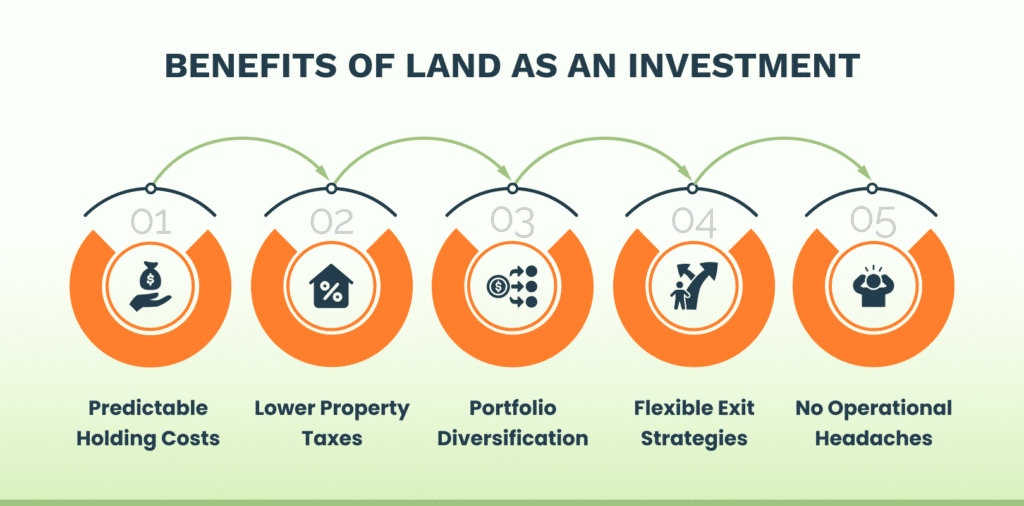

Benefits of Land as an Asset Class

As an investment vehicle, land offers stability without operational complexity, making it a practical asset class for investors focused on control, downside protection, and measured growth potential.

Key, non‑obvious benefits land investors focus on:

- Land value appreciation is tied to zoning regulations, land-use changes, and nearby development plans, not to building condition or depreciation.

- Lower property taxes, minimal maintenance, and predictable holding costs improve capital efficiency versus developed real estate.

- Acts as portfolio diversification against the stock market, including the S&P 500 and exchange‑traded funds.

- Flexible exit options: future development, resale to builders, or long‑term hold aligned with population growth.

- Supports multiple investment strategies, from rural land banking to parcels near urban centers with infrastructure expansion.

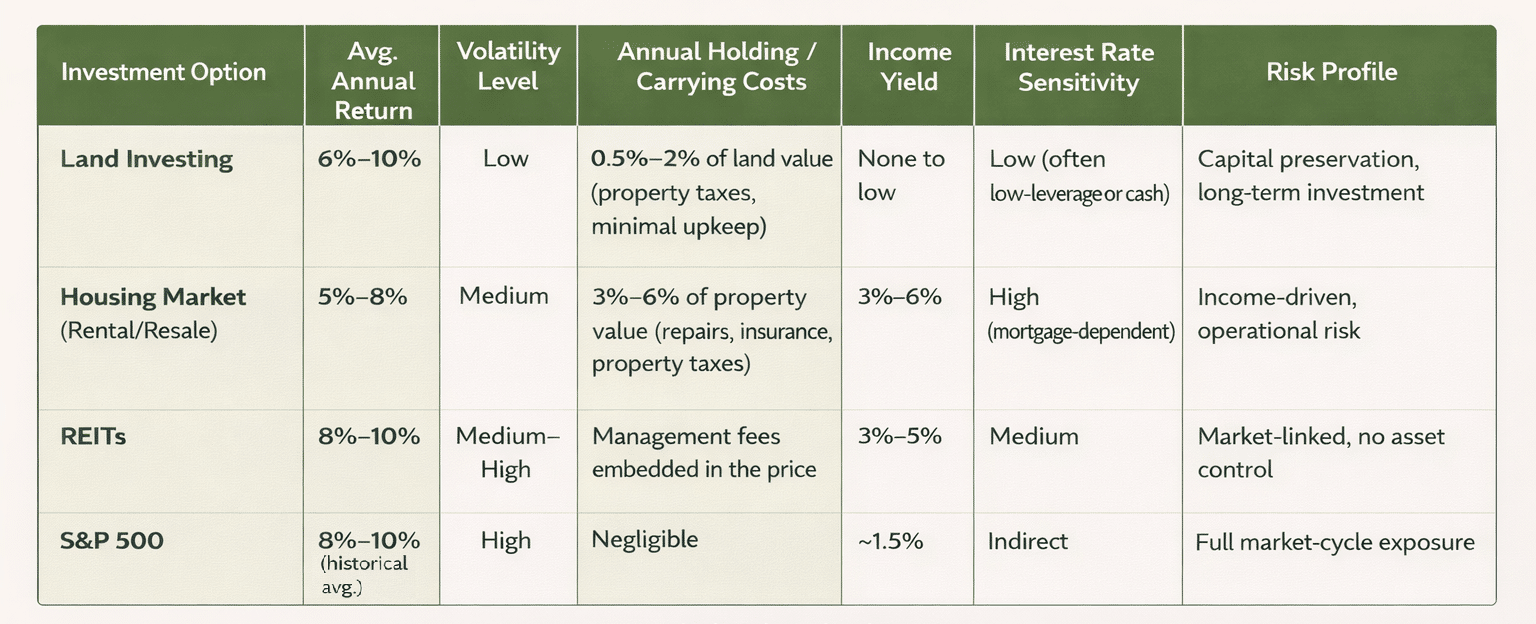

How Land Compares to Other Investment Options?

For investors focused on capital preservation, controlled risk, and long‑term investment performance, land remains one of the few real estate investments with limited operational exposure and predictable downside.

Risk & volatility

- The S&P 500 has historically seen drawdowns of 30–50% during downturns (2008, 2020, 2022).

- Land values rarely experience sharp drops because land is a finite resource, and supply cannot increase. Price corrections tend to be localized, not market‑wide.

- Unlike exchange‑traded funds or real estate investment trusts, land does not react to daily market sentiment.

Cost structure

- Developed real estate typically carries 1–3% of property value annually in maintenance, insurance, and management.

- Land ownership eliminates maintenance entirely and keeps holding costs limited to property taxes and minimal insurance.

- No tenant‑related expenses, vacancy risk, or capital expenditure cycles.

Interest‑rate exposure

- Rising interest rates directly impact housing affordability and mortgage‑dependent assets.

- Many land investors use cash purchases or low‑leverage land loans, reducing sensitivity to interest rate increases.

- Monthly obligations are often limited to property taxes rather than full mortgage payments.

Performance characteristics

- Land value is driven by population growth, zoning regulations, land use changes, and development plans, not finishes or structures.

- Rural land near expanding urban centers has historically benefited from rezoning or infrastructure expansion, producing outsized value appreciation relative to holding costs.

- Unlike housing, land does not depreciate over time.

Portfolio impact

- Land functions as a stabilizing asset class inside an investment portfolio.

- It reduces correlation with the stock market and housing market, improving portfolio diversification during periods of market volatility.

Exploring Different Types of Land Investments

Each land parcel serves a different investment strategy. The best land investors match land type to holding capacity, capital structure, and exit timing, rather than chasing acreage or price alone.

Vacant land

- Typically located near expanding urban centers or along future development corridors.

- Carrying costs are low: mainly property taxes and minimal insurance.

- No depreciation risk and no maintenance.

- Value is driven by zoning regulations, road access, utilities, and population growth.

- Commonly used for future development or resale once land use changes.

Raw land

- Undeveloped land without utilities, road access, or entitlements.

- Requires deeper due diligence: zoning restrictions, environmental considerations, flood plain status, and water rights.

- Higher growth potential but longer holding periods.

- Often priced lower per acre, making it attractive for investors with a long‑term investment horizon.

- Returns are tied to land development timelines and infrastructure expansion.

Agricultural land (farmland)

- Generates passive income through agricultural leasing.

- Historically shows lower volatility than the stock market.

- Value supported by food demand, natural resources, and limited supply.

- Often benefits from tax advantages and predictable land ownership costs.

- Performs well as a hedge during market volatility.

Residential land

- Positioned for housing demand and zoning‑approved development.

- Influenced by housing market trends, local employment data, and school districts.

- Strong alignment with population growth and urban expansion.

- Often benefits from tax advantages and predictable land ownership costs.

- Often favored by builders to increase exit liquidity.

Commercial land

- Used for retail, industrial, or mixed‑use projects.

- Value tied to traffic counts, zoning approvals, and proximity to infrastructure.

- Higher upside but more sensitive to interest rate changes and development costs.

- Plays a role in income‑focused commercial real estate strategies once developed.

Key Considerations for a Successful Land Purchase

Before buying land, returns are determined less by vision and more by math. These benchmarks help land investors evaluate risk, cash requirements, and downside exposure in 2026.

Cost benchmarks to evaluate before buying land

- Property taxes: Typically 0.3%–2% of market value annually, depending on state and land use classification.

- Holding costs: Average $300–$1,500 per year for vacant or raw land (taxes + minimal insurance + HOA, if applicable).

- Land loans: Interest rate usually 1–3% higher than residential mortgages; shorter terms (5–15 years).

- Upfront costs: Expect 20%–50% down payment for most land purchases.

- Utilities & access: Extending road access, water rights, or power can range from $5,000 to $50,000+, depending on distance and zoning regulations.

- Environmental checks: Flood plain reviews, surveys, and soil tests typically cost $1,000–$4,000 during due diligence.

Interest rate impact on land investments

- A 1% increase in interest rates raises annual carrying costs by roughly 8–12% on financed land.

- Cash buyers avoid interest risk entirely, which is why land investing favors low‑leverage strategies.

- Higher rates slow speculative buyers, often improving acquisition pricing for disciplined investors.

Pros vs Cons of Investing in Land

Advantages

- No depreciation or repair costs ($0 maintenance compared to housing assets).

- Holding costs are 60–90% lower than residential property investments.

- Long‑term land value appreciation historically tracks or exceeds inflation.

- Agricultural land can produce 2%–5% annual passive income through leasing.

- Portfolio diversification reduces correlation with the stock market and exchange‑traded funds.

Challenges

- No immediate cash flow unless leased or developed ($0 income by default).

- Development timelines can extend 3–10+ years, depending on zoning and approvals.

- Liquidity is lower; average resale timelines are 2–4× longer than housing.

- Market value can remain flat in the short term without population growth or infrastructure expansion.

- Land loans increase the total cost of capital due to higher interest rates and shorter terms.

Land investing works best for people who are comfortable waiting for value to show up. It doesn’t rely on tenants, renovations, or constant decision‑making. But it also isn’t passive by default; the outcome depends on how well you understand zoning, timing, and the local market before you buy.

What works in your favour?

- Lower tax burden: Vacant land and rural land usually have lower property taxes than houses or commercial buildings, which keeps holding costs more predictable.

- Simple ownership: No tenants, no maintenance calls, no insurance claims for broken systems. For many investors, that simplicity is the biggest advantage.

- Long‑term value play: Land tends to reward patience. When population growth, development plans, or infrastructure catch up, land value moves without needing upgrades.

- Portfolio balance: Because land doesn’t behave like stocks or the housing market, it adds stability to an investment portfolio during market volatility.

Where do investors get caught?

- Zoning limits everything: You can’t “fix” bad zoning. If land-use restrictions don’t allow development, the upside stays capped no matter how cheap the purchase price looks.

- Ongoing carrying costs: Even unused land has expenses, property taxes, insurance, and interest costs if you’re using land loans. These add up over time.

- Slower exits: Land doesn’t always sell quickly. Market value changes gradually, so returns depend more on timing than on speed.

- Research matters more than price: Buying land without understanding access, water rights, floodplain risk, or future development plans is where most losses occur.

How The Land Method Simplifies Land Investing?

Most mistakes in land investing come from buying without clear rules. The Land Method focuses on decision discipline, what to check, what to ignore, and when to walk away.

How it actually reduces risk

- Fast deal elimination: Investors are taught to reject land parcels early based on zoning regulations, land‑use restrictions, lack of road access, flood-plain exposure, or unclear water rights, before time or money is spent.

- Cost visibility upfront: Property taxes, carrying costs, land loans, and interest rate impact are calculated before offers are made, so holding a lot of land doesn’t erode returns quietly.

- Location over size: The system prioritizes where demand will form near urban centers, infrastructure corridors, and development plans rather than buying acres of land without an exit path.

- Market‑specific analysis: Instead of national averages, investors learn how to price land using local market value, comparable land parcels, and realistic absorption timelines.

- Repeatable execution: The focus is on building a pipeline of land purchases that fit defined investment goals, not chasing isolated “good investment” opportunities.

The result is a land investing process that favors predictability over speculation and controlled growth over volume.

FAQs

- Does land still make sense as an investment in 2026?

For many investors, yes because land doesn’t react to headlines the way stocks, REITs, or the S&P 500 do. There’s no tenant risk, no vacancy cycle, and no daily price swings. If the location works and the numbers make sense, land tends to move on its own timeline. - What costs do people usually underestimate when buying land?

It’s rarely the purchase price that causes trouble. It’s property taxes, carrying costs, interest on land loans, and basic access issues like roads or surveys. These add up quietly if they’re not checked upfront. - Why is zoning such a big deal with land investments?

Because zoning decides what the land can actually be used for. A cheap parcel isn’t a deal if zoning regulations or land‑use restrictions block resale or development. With land, legal use matters more than square footage. - How long do investors usually hold land before seeing returns?

Land isn’t a flip‑and‑forget asset. Some deals turn over in a few years, others take longer and rely on population growth or development plans. The timeline depends on why you bought the land and how patient your capital is.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.