Distressed properties exist because something went wrong, not because the property itself is bad. In 2026, that “something” is usually higher interest payments, rising property taxes, insurance costs, or unresolved ownership issues. When pressure builds, owners stop negotiating for top dollar and start looking for an exit. That’s where real opportunity shows up.

For real estate investors, distressed properties are not about timing the market. They’re about buying below market value because the situation demands it. Foreclosed homes, short sales, and bank‑owned property often trade before hitting standard property listings. When sourced through public records, lender releases, or direct owner contact, these deals give investors control over price, risk, and margin.

At The Land Method, distressed deals are approached with structure, not guesswork. Active investors focus on market value first, then work backward. Title issues, delinquent taxes, unpaid property taxes, and repair exposure are reviewed upfront. If the numbers don’t work on paper, the deal stops there. This approach removes emotion and keeps the investment grounded in facts.

This section breaks down how distressed properties actually enter the market, which types are worth pursuing, and how disciplined real estate investing turns motivated sellers into consistent, repeatable deals.

What Are Distressed Properties and Their Types?

A distressed property is typically sold below market value because the owner can’t hold it anymore. The discount comes from urgency, not from a lack of demand.

In real estate investing, that distinction matters. Pricing is driven by deadlines, lender pressure, or legal exposure, not optimism.

Common signs of a distressed property

- Missed mortgage payments or default notices

- Delinquent property taxes or unpaid liens

- Probate, inheritance, or unresolved title issues

- A current owner with limited room to negotiate

These conditions create price gaps, but only if due diligence is done correctly.

Types of Distressed Properties

Not all distressed properties behave the same. Each type carries different risks, timelines, and holding costs.

Foreclosed property

Assets taken back by a mortgage lender after the foreclosure process. If the auction fails, they are resold as bank‑owned property.

Short sale

A sale approved by the mortgage lender where the sale price is lower than the loan balance. These deals move slowly but can produce a lower purchase price.

Bank‑owned property (REO)

Properties held by lenders after foreclosure. Titles are usually cleaner, pricing is firm, and timelines are strict.

Distressed residential properties

Single‑family homes and multi‑family homes where owners can no longer cover mortgage payments, taxes, or basic upkeep.

Distressed commercial properties

Retail, office, or mixed‑use assets affected by lost tenants, falling cash flow, or rising interest rate pressure.

Tax‑distressed properties

Properties with delinquent taxes are sold through county auctions or government agencies. These require careful title review.

Why Invest in Distressed Properties?

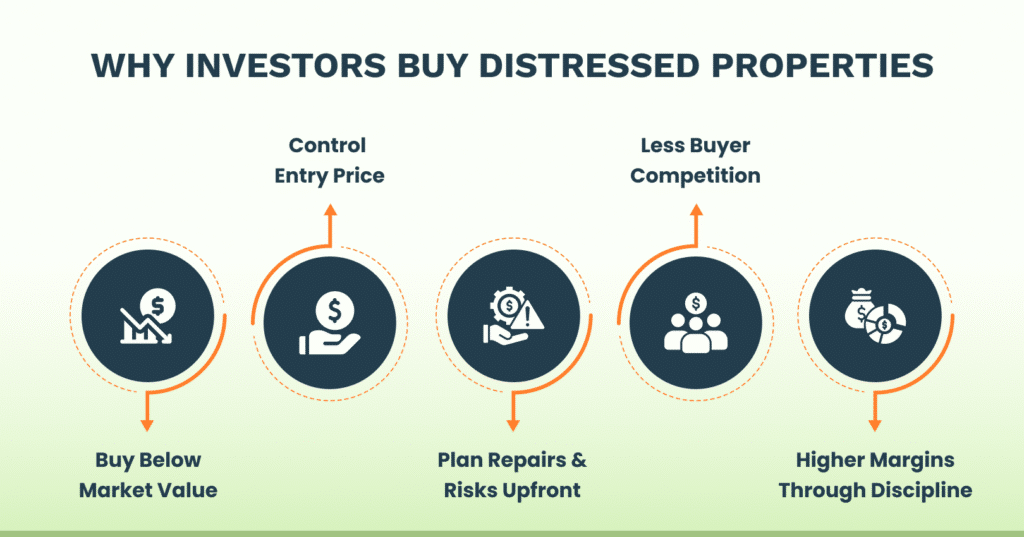

Distressed properties attract real estate investors for one reason: problems force discounts. When an owner is facing foreclosure, a short sale deadline, unpaid property taxes, or title issues, speed matters more than price.

These properties are not priced on future potential. They’re priced to end a situation. That creates room for profit if the deal is bought correctly.

A distressed home or foreclosed property allows investors to reduce risk by controlling the entry price. Repairs, legal cleanup, or repositioning are planned into the numbers, not discovered later.

Distressed properties also offer flexibility. Investors may resell after cleanup, convert commercial properties to rentals, or restructure them once cash flow stabilizes. In commercial real estate, fewer buyers are willing to navigate complexity, which often leads to wider margins.

For experienced investors, this isn’t about chasing a “good deal.” It’s about process, discipline, and a repeatable investing strategy.

How to Find and Buy Distressed Properties?

Finding distressed properties isn’t about secret lists. Financial stress always leaves a trail, and that’s where serious investors look.

Where Distressed Properties Actually Come From?

County public records

Foreclosure filings, probate records, delinquent tax lists, and code violations identify distress early before the open real estate market sees it.

Lender inventory

Bank‑owned property is released after failed auctions. These deals move fast and follow strict lender rules.

Targeted platforms

Sites like Foreclosure.com are useful for verification, not pricing. Status matters more than the asking price.

Direct seller situations

Motivated sellers dealing with foreclosure, tax default, or ownership issues. These deals usually come through outreach or referrals, not browsing listings.

How to Buy a Distressed Property With Clarity?

Confirm market value first

Use recent sale price data from similar properties. Market value sets the ceiling.

Run numbers before inspections

If the spread doesn’t cover repairs, holding costs, property taxes, and closing costs, walk away.

Inspect only for deal breakers

Structure, foundation, roof, utilities. Cosmetic home repairs are secondary.

Verify title and ownership

Unpaid liens, title issues, and delinquent taxes follow the property, not the seller.

Confirm financing early

Many mortgage lenders limit distressed purchases. Interest rate, loan terms, and monthly mortgage payment must match the exit strategy.

Market Trends and Opportunities in 2026

In 2026, distressed opportunities are driven by financial pressure, not collapsing prices.

What’s driving distress?

- Interest rate resets on adjustable loans

- Rising property taxes and insurance costs

- Investors misjudge holding costs

Where are deals showing up?

- Secondary metros near major urban centers

- Investor‑owned inventory under pressure

- Smaller residential properties with high carrying costs

Cities Drawing Investor Attention

Los Angeles

Florida Gulf Coast – High Insurance costs and rising foreclosures allow investors the opportunity to get good profit deals.

Las Vegas

Short sales and foreclosed homes tied to adjustable‑rate loans continue to surface.

New York

Selective opportunities in small multifamily properties with estate or title complications.

Why Distressed Properties Still Make Sense in 2026?

Tighter lending means fewer refinancing options and more motivated sellers. Institutions like Bank of America, Wells Fargo, and Freddie Mac continue releasing distressed inventory at a steady pace.

Margins in 2026 come from discipline, not volume. Conservative pricing, controlled repairs, and fast exits matter more than chasing scale.

How The Land Method Supports Distressed Property Investors?

The Land Method teaches investors how to remove emotion from distressed deals.

- Built by active operators, not educators

- Step‑based deal evaluation systems

- Early identification of title and tax risk

- Focus on repeatable deal pipelines, not one‑offs

- Designed for shifting interest rates and lending standards

Distressed properties reward preparation. When the process is solid, the opportunities remain consistent, even in changing market conditions.

FAQs

- Are distressed properties always cheaper than market value?

Not automatically. A distressed property is often listed below market value, but the real discount shows up only after factoring in home repairs, property taxes, title issues, and closing costs. Experienced real estate investors calculate the true purchase price by comparing the sale price to the market price and required capital. Only then does it qualify as a good deal. - Can first‑time homebuyers invest in distressed homes, or is it only for investors?

Homebuyers can buy a distressed home, but financing options are more limited. Many mortgage lenders require properties to meet livability standards, which distressed houses often don’t. This is why real estate investors with flexible financing options or private capital tend to move faster and secure better real estate deals. - How risky are properties with delinquent taxes or title issues?

They’re not risky if evaluated correctly, but they are unforgiving if ignored. Delinquent taxes, unpaid liens, or unresolved title issues attach to the property, not the current owner. Real estate professionals verify ownership, public records, and legal exposure before closing. Skipping this step is one of the fastest ways to erase profit margins. - What’s the biggest mistake investors make when buying distressed properties?

Relying on the list price instead of real numbers. Many investors chase distressed sales without validating market value, mortgage rates, holding costs, or monthly mortgage payment assumptions. Successful real estate investing starts with conservative pricing, not optimistic exits, especially in changing market conditions.

- Do distressed properties still make sense as rental property investments in 2026?

Yes, but only in specific markets. Distressed residential properties can be profitable rental investments when the purchase price, interest rate, and ongoing property taxes align with realistic rental rates. In 2026, strong rental demand alone doesn’t justify a deal; disciplined underwriting does

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.