Raw land flipping is the simplest form of real estate investing: you buy a vacant parcel at the right price and resell it for more without renovating, managing contractors, or dealing with tenants. It’s a clean numbers-driven model where your profit comes from spotting value before the rest of the market notices.

Unlike house flipping, you’re not repairing roofs, pulling permits, or waiting on inspectors. Your job is to understand zoning, confirm access, and negotiate a price that leaves room for a spread. That’s it.

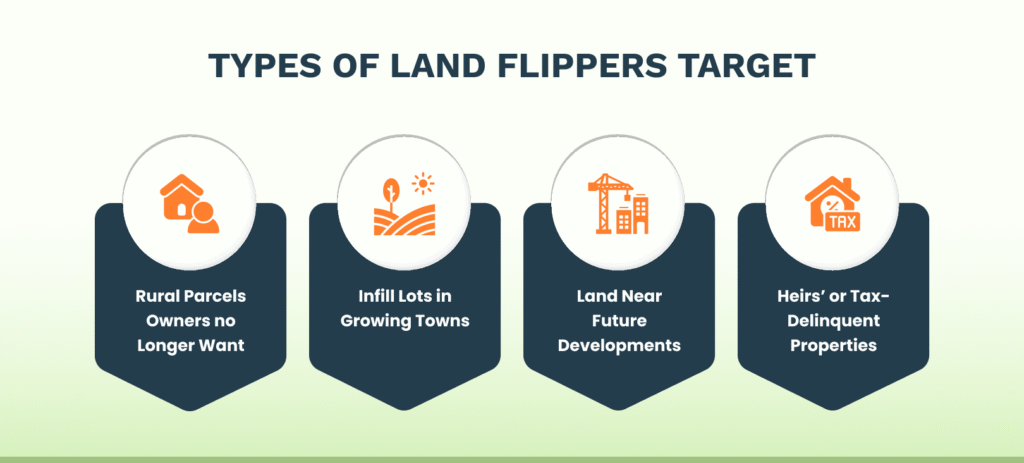

Most land flippers focus on:

- Vacant rural parcel owners no longer want

- Infill lots inside growing towns

- Undeveloped land near upcoming residential or commercial projects

- Heirs’ properties or tax-delinquent land where the owner prefers a quick sale

And because raw land is cheaper than traditional real estate, you can flip multiple parcels at once instead of tying all your capital to a single property.

How Land Flipping Differs from Traditional Real Estate?

Raw land flipping works nothing like flipping houses, and that’s exactly why more investors are shifting to it in 2026. There are fewer moving parts, fewer surprise repairs, and far cleaner due diligence. Instead of chasing contractors, dealing with inspections, or negotiating repair credits, land flippers focus on data, timing, and pricing.

Here’s the real difference, broken down simply:

1. No Structural Repairs, Ever

Flipping houses means dealing with:

- HVAC failures

- Roof replacements

- Plumbing issues

- Inspections are holding up closings

Raw land flipping removes all of that. There’s nothing to fix, just zoning checks, access verification, and market comps. This alone cuts weeks (and thousands of dollars) from the process.

2. Lower Holding Costs

Houses incur:

- Taxes

- Repairs

- Insurance

- Maintenance

Vacant land typically costs almost nothing to hold. Property taxes are lower, and there are zero carrying costs beyond that.

3. Faster, Simpler Closings

Raw land deals close quickly because:

- Title searches are simpler

- No appraisals are necessary

- No inspections, no Agents, etc.

It’s common for land flippers to close a deal in two to eight weeks, something almost unheard of in house flipping.

4. Less Competition, More Flexibility

Traditional real estate is crowded and emotional. Buyers compare granite countertops and school districts.

Land buyers, on the other hand, compare:

- Price per acre

- Zoning laws

- Access

- Development potential

This makes negotiation more straightforward and less emotional, which is why seasoned real estate investors prefer flipping land when they want predictable profit margins.

5. Easier to Work Remotely

You can flip land from anywhere.

Many land investors have never visited a single parcel they’ve sold.

With digital tools like:

- County GIS maps

- Remote sensing data

- Google Earth

- E-signature contracts

…you can buy and sell parcels in any state without setting foot on the property.

Where does it take you?

Flipping houses is Daunting.

Flipping raw land is Simple.

One requires managing repairs and contractors.

The other requires managing due diligence, negotiation, and timing.

If your goal is cleaner transactions, lower risk, and easier scalability, raw land flipping is far more efficient than the traditional fix-and-flip model.

Why Raw Land Is a Top Real Estate Investment?

When you understand market value, zoning laws, and local market conditions, raw land becomes one of the most predictable ways to scale returns in 2026.

1. High Returns in the Right Markets

Certain counties across the United States continue to offer strong spreads for land flippers, especially in areas experiencing population growth or early-stage development.

Examples investors focus on:

- Urban edge counties are preparing for residential development (new schools, road expansions).

- Emerging suburban corridors where land prices rise long before builders arrive.

- Rural areas where parcels still sell at a lower price but appreciate quickly once utilities or zoning improvements are planned.

A $10,000–$20,000 vacant parcel can flip for double once you find a buyer who understands its future development potential. That’s where experienced land flippers outpace house flippers: fewer repairs, fewer surprises, better margins.

2. Less Competition, More Unique Opportunities

Raw land flipping isn’t crowded.

Most real estate investors chase renovated homes, rentals, or commercial properties; very few know how to evaluate undeveloped land, flood zones, or county-level zoning maps.

This gives land flippers:

- Lower acquisition costs

- Higher negotiation power with landowners

- Access to off-market deals no one else is chasing

- Better profit margins due to minimal holding costs

Direct mail, social media, and off-market outreach consistently uncover motivated sellers, often landowners who inherited the property or no longer live in the area.

3. Growth Potential Driven by New Development

Raw land appreciates long before construction begins.

Flippers who study development plans, infrastructure projects, and zoning changes often buy land months (or years) before demand peaks.

Key growth signals include:

- Upcoming highway expansions

- Newly approved residential development

- Proposed shopping centers or commercial properties

- County agenda items discussing zoning updates

When these show up, land prices follow.

A savvy flipper gets in at the right price, and sells it for a profit a short time later..

Steps to Secure a Profitable Deal

The best land flippers avoid surprises by running tight due diligence and checking the few factors that can make or break a deal.

1. Conduct Thorough Research & Environmental Checks

Before securing a parcel of land, verify the conditions that directly affect resale speed and profit margins.

- Confirm zoning laws and land use rules with the county (not the listing). A quick phone call to planning can reveal setbacks, building restrictions, or limitations on residential development or commercial properties.

- Check environmental issues, especially flood zones, wetlands, or protected areas. A parcel sitting in FEMA Zone AE or on mapped wetlands will slow your exit strategy and shrink your buyer pool.

- Review local market conditions using recent comps, population growth patterns, and planned development projects. Areas preparing for new subdivisions, highways, or infrastructure projects respond exceptionally well to raw land flipping.

Real estate investors who skip these checks often end up with a “good price” land deal that becomes impossible to flip.

2. Secure Financing with the Right Structure

Raw land flipping doesn’t always require big bank loans. The right financing structure lowers risk and speeds up your exit.

- Owner financing helps in competitive markets because you can offer a smoother deal structure to sellers and still flip the parcel at a higher price later.

- Private lenders are ideal for quick flips where speed matters more than interest rates.

- Traditional bank loans work, but expect higher interest rates and tighter requirements for undeveloped land.

Choose the financing option that fits your holding costs, not the one that just looks cheapest upfront.

3. Evaluate Holding Costs Before Committing

Even a great land deal becomes a burden if holding costs are ignored. Calculate:

- Annual property taxes

- If applicable, HOA or road maintenance fees

- Loan interest if using a bank loan or a private lender

- Expected time to resale based on buyer demand

A profitable deal isn’t just about buying low and selling high; it’s about keeping the land affordable to hold while waiting for the right buyer.

Strategies to Attract the Right Buyer

Flipping land isn’t about finding any buyer; it’s about positioning your parcel in front of people who already want that type of land. Here’s how land flippers in 2026 are getting buyers fast without sounding salesy or relying on generic marketing tactics.

1. Market the Land Based on Its Real Use Case

Buyers respond to clarity, not hype. Highlight what the parcel can actually support based on zoning laws, utilities, and surrounding development plans.

- If zoning allows residential development, focus on first-time homebuyers, small builders, or investors seeking entry-level lots.

- If it’s ideal for commercial real estate, position it toward buyers building offices, storage facilities, or local retail spaces.

- If it’s rural or undeveloped land, target recreational buyers, long-term land investors, or those pursuing seller financing.

2. Use Real Local Drivers to Boost Demand

Instead of generic statements (“upcoming area,” “great opportunity”), speak directly about measurable drivers:

- A new school or hospital is planned within 2 miles

- Highway expansion or infrastructure projects approved by the county

- Population growth that proves rising land value

- Rezoning updates that open the door for residential development

Buyers today want evidence, not adjectives. Use planning department data, maps, and screenshots to strengthen your listing.

3. Lean on Social Media Where Land Buyers Actually Hang Out

Not all platforms produce buyers. The ones that work for flipping land:

- Facebook Marketplace & Land Investor Groups — first-time homebuyers, investors, and cash buyers

- Instagram Reels — high visibility for showcasing drone shots or before/after clearing

- TikTok — short explainer videos on zoning, acreage, or development plans

- YouTube — simple walkthroughs (“Here’s what you can build on this parcel…”) build trust fast

4. Present the Parcel Like a Development-Ready Option

Most buyers have never purchased land before, so they don’t understand the process. When you hand them the details upfront, your parcel becomes the easiest one to buy.

Provide:

- County zoning confirmation

- Perc test results (if done)

- GPS boundaries or a quick GIS screenshot

- Utility distance estimates

- Photos of access roads

5. Target Buyers Based on Their End Goal

Different buyers respond to different benefits:

- First-time homebuyers: Emphasize affordable entry points and owner financing.

- Investors: Highlight market value comps, cashflow potential, or a quick flip opportunity.

- Builders: Provide lot size, setbacks, and buildable area to help them run numbers fast.

- Commercial buyers: Show proximity to traffic corridors or population growth.

Overcoming Challenges in Land Flipping

Flipping land is often simpler than flipping houses, but the challenges that do show up can kill a deal if you’re not prepared. Here are the hurdles most new land flippers face, and how experienced investors (including students inside The Land Method) deal with them quickly and cleanly:

1. Market Fluctuations Don’t Hit Land the Same Way, but They Still Matter

Land doesn’t depreciate as buildings do, but demand cycles still affect market value.

The key is watching local market conditions, not national headlines.

If days-on-market jump or active listings double, you tighten your offer numbers, not abandon the market.

Land flipping is about buying right, not timing perfectly.

2. Legal Issues Can Delay a Flip, Fix Them Before You Buy

A title hiccup on land is different from a house:

– unresolved easements

– missing access

– incorrect legal descriptions

– inherited parcels stuck in probate

Experienced land flippers run due diligence before contract signing, not after.

A quick call to a real estate attorney, paired with a preliminary title pull, solves 90% of future headaches.

3. Environmental Regulations Aren’t a Deal Breaker, If You Catch Them Early

Vacant land can hide issues:

– flood zones

– wetlands

– protected habitat areas

The trick is not avoiding these parcels entirely; it’s buying them at the right price.

Plenty of flippers specialize in “problem parcels” because they understand what the county will and won’t allow.

4. Holding Costs Can Eat Into Profit, So Speed Matters

Land doesn’t have utilities, tenants, or repairs…

But it does have:

– property taxes

– loan interest (if financed)

– marketing costs

A profitable flip happens when you buy, market, and exit quickly, which is why most successful flippers push for a 30–90 day turnaround.

With The Land Method, students use prebuilt scripts, buyer-list workflows, and pricing templates to reduce hold time dramatically.

Is Raw Land Flipping the Best Real Estate Strategy for 2026?

Raw land flipping is gaining momentum again in 2026, mainly because investors are looking for high-margin deals that don’t require the renovation headaches of traditional real estate. With construction costs still unstable and interest rates affecting developed properties more than land, unimproved parcels offer a cleaner, more predictable path to profit.

Here’s why many real estate investors are shifting their strategy this year:

1. Strong Economic Tailwinds for Land Investors

Counties across the United States continue expanding transportation corridors, utility lines, and residential development zones. Wherever infrastructure goes, land values rise, and raw land owners benefit first.

2. Better Profit Margins Than Most Traditional Real Estate Deals

Flipping land avoids the major cost drivers of house flipping, such as no contractors, permits, inspections, or renovation delays.

Instead, your profit margin comes from:

- Buying undervalued parcels at the right price

- Cleaning up title issues

- Clarifying zoning

- Positioning the land for a buyer who sees development potential

A simple improvement like confirming legal access or updating a survey can raise market value by 20–40% without touching the dirt.

3. Easier to Scale Than Homes, Rentals, or Commercial Builds

Raw land doesn’t demand the same capital, time, or holding responsibilities.

That means an investor can:

- Flip multiple parcels per month

- Target new off-market deals across several states

- Use seller financing to keep cash flow steady

Many land flippers entering 2026 are scaling faster than house flippers who are tied up in contractors, supply chain delays, or buyer contingencies.

4. Flexible Exit Strategies Based on the Local Market

Your exit strategy determines your profit, and land offers several:

- Quick flip to builders

- Seller financing for first-time homebuyers

- Cash buyer resales for investors wanting build-ready lots

- Assigning the contract for fast income with minimal holding costs

Because land appeals to multiple buyer types, investors aren’t boxed into one resale path.

5. Works in Both High-Growth and Low-Competition Markets

Urban areas bring higher appreciation.

Rural areas bring lower acquisition prices and less competition.

Suburban edges bring the best mix of both.

That creates a wide range of investment opportunities depending on your capital, strategy, and risk tolerance.

Bottom Line

Raw land flipping remains one of the best real estate investment strategies in 2026 for investors who want:

- Low overhead

- High flexibility

- Minimal competition

- Strong profit margins

- A business model they can run remotely

With the right due diligence, market research, and financing structure, flipping land continues to outperform many traditional real estate strategies, especially in a year where developers are eager for buildable lots and inventory remains tight.

Is Raw Land Flipping the Best Real Estate Strategy for 2026?

Raw land flipping continues to outperform many traditional real estate strategies in 2026 and not because it’s “easy,” but because it rewards investors who know how to analyze zoning, market velocity, and land-use potential better than the average land flipper.

And this is precisely where we, The Land Method, separate ourselves from everyone else.

Unlike most programs taught by people who stopped doing deals years ago, our founders, Ginis Garcia and Jonathan Haveles, are actively working the same land market they teach. Our systems, valuation templates, and due diligence workflows are based on real transactions completed every single month, not recycled theories.

Here’s why our approach works so well for raw land flipping:

1. We Teach You to Spot Value Before Anyone Else Sees It

Students learn to dissect zoning laws, GIS data, and county growth plans so they can buy at the right price before developers and agents push values up. This is how raw land flippers consistently buy low and sell high.

2. Every Deal Has Multiple Exit Options

Whether you’re doing:

- a quick wholesale deal,

- a seller-financed note for recurring cash flow, or

- a simple clean-and-resell flip,

You’re working from a structure that reduces risk and increases profit margins.

3. Support That Follows the Actual Market

Our Land Riches Blueprint: Coaching Edition is updated frequently, sometimes quarterly, so your strategy always reflects:

- current interest rates,

- shifting zoning regulations,

- new infrastructure projects,

- and updated county workflows.

You’re never working with outdated information.

4. Practical, Not Theoretical, Guidance

Through our Crushing Land™ series, students see live examples, not hypotheticals. From analyzing title issues to breaking down environmental flags, you watch real investors solve real deal challenges.

5. Built for Both Beginners and Experienced Investors

Some of our students are full-time flippers looking to scale; others are complete beginners who’ve never done a land deal. The system works for both because everything is step-by-step, from sourcing parcels to negotiating to exiting at the right time.

To Conclude

Raw land flipping is one of the strongest real estate strategies heading into 2026 if you know how to evaluate land correctly. The Land Method gives you the tools, structure, and real-world guidance to flip land with confidence, minimize holding costs, and maximize profit margins.

If you’re ready to upgrade your process, build a pipeline of profitable land deals, and work directly with active investors who still do this every day, you’ll be in good hands here.

FAQs

1. Does The Land Method teach raw land flipping for beginners?

Yes, the program is built so beginners can follow a step-by-step system. Students learn how to evaluate zoning, pull accurate comps, structure seller financing, and flip land without relying on agents or prior real estate experience.

2. How does The Land Method help reduce my risk when flipping land?

We give you the exact due diligence workflow our founders use, GIS verification, access checks, environmental red flags, tax reviews, and valuation compression steps. This eliminates “blind offers” and protects you from overpaying.

3. Can I flip land in the U.S. if I don’t live in the country?

Absolutely. Many of our students operate from outside the United States. We teach a remote-friendly model using online county records, digital contracts, virtual closings, and verified title companies.

4. What makes The Land Method different from other land-flipping courses?

Unlike theory-heavy programs, our founders (Ginis & Jonathan) flip land every week. The Blueprint includes updated scripts, deal breakdowns, CRM automations, seller-negotiation templates, and live “Crushing Land” sessions where you watch real deals unfold.

5. How quickly can I close a profitable raw land flip using the system?

Most students begin making offers within 2–4 weeks. Flips typically close in 30–90 days, depending on access, title work, and the chosen exit strategy (assignment, double close, or seller financing). The course helps you choose the fastest path based on your budget and deal structure.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.