If you’re looking for a real estate strategy that doesn’t rely on renovations, tenants, or heavy capital, land flipping remains one of the most efficient paths to profit heading into 2026. What makes this model work isn’t speculation, it’s process. And that’s exactly what we teach at The Land Method.

For years, we’ve shown new and experienced real estate investors how to turn vacant land and undeveloped parcels into fast, predictable returns using data-driven evaluations, zoning analysis, seller-financing strategies, and clean exit plans. Land flipping works because the margins are real: low acquisition costs, minimal holding costs, and the ability to buy properties other investors skip because they don’t know how to evaluate land the right way.

What gives our approach an edge is simple:

We actually flip land every day, and we built our system from the same workflows we use in our own business. If you’ve watched our YouTube conversations or breakdowns, you already know we don’t deal in theory. We show the numbers, the steps, and the mistakes to avoid.

As we move into 2026, the opportunity is clear: more people want affordable land, inventory remains tight, and counties continue opening new development corridors. For disciplined land flippers, this creates a perfect window to buy right, sell high, and scale a land business without working full-time or taking on risky renovations.

Key Takeaways

- Land flipping offers lower acquisition costs, minimal holding costs, and higher profit margins than house flipping.

- Vacant land attracts less competition, giving new and seasoned investors more negotiation power and room for higher returns.

- Smart flipping requires zoning clarity, tight due diligence, and accurate valuation, all core components taught inside The Land Method.

- Owner financing and flexible loan options help investors scale without relying heavily on banks.

- With the right marketing strategy and exit plan, land flippers can resell parcels quickly while maximizing sale price and minimizing taxes.

- Our founders, Ginis Garcia and Jonathan Haveles, teach a repeatable acquisition system based on real weekly deals, not theory, helping investors flip land confidently in 2026’s market.

What Makes Land Flipping a Profitable Investment Strategy?

Why flipping land continues to outperform traditional real estate strategies going into 2026.

Lower Acquisition Costs = Higher Profit Margins

When you’re flipping land, your money goes directly into the deal, not repairs, not contractors, not inspections. Vacant land typically sells at a fraction of the cost of houses or commercial buildings, which means you can buy more parcels, test more markets, and scale faster.

Minimal Holding Costs (No Tenants, No Renovations, No Surprises)

While house flippers juggle HVAC failures and contractor delays, land flippers deal with property taxes, marketing costs, and the occasional due diligence expense, and that’s usually it. No leaking roofs, no emergency repairs, no maintenance budget. Your margins stay intact, and your timeline stays in your control.

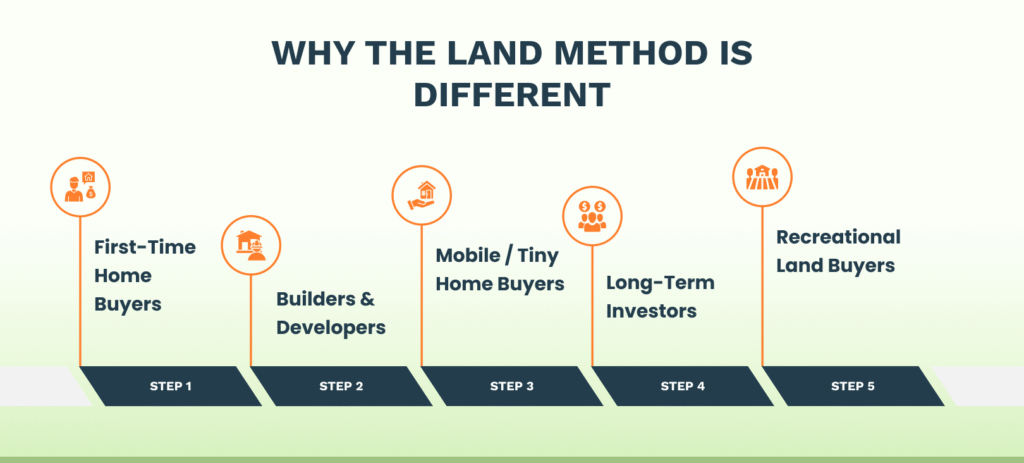

Bigger Buyer Pool Than Most New Investors Expect

Vacant land attracts first-time homebuyers, builders, mobile home buyers, small developers, and investors looking for long-term holds. Because you’re flipping a blank slate, the potential uses are wider, and the buyer pool follows. If you price the parcel right and highlight zoning potential, land tends to move faster than most people assume.

Less Competition Than Traditional House Flipping

House flipping is crowded. Everyone and their uncle is trying to wholesale or flip homes.

Land flipping is the opposite: still quiet, still overlooked, and still full of motivated sellers willing to accept a lower price because they don’t know what to do with the property. This gives land flippers room to negotiate, experiment, and grow without fighting 20 other investors for the same deal.

A Strategy Built Based On Data

With land, you’re working with zoning maps, assessed values, comps, satellite imagery, and county records. No emotional sellers. No bidding wars. Just clean numbers that tell you whether the deal makes sense.

It’s why our investors succeed: the model is predictable when you know how to evaluate land properly.

How Land Flipping Differs from Flipping Houses?

Land flipping in 2026 is a completely different business model than flipping houses, and that’s exactly why real estate investors are shifting toward vacant land. No contractors. No renovations. No waiting on permits that drag out timelines or inflate holding costs.

Here’s the real, practical distinction:

1. No Construction = Cleaner Profit Margins

When you’re flipping land, your cost structure is straightforward:

- acquisition price

- due diligence

- minimal holding costs

- marketing

That’s it.

Compare that to house flipping, where profit margins get eaten alive by: repairs, labor delays, supply issues, inspections, and changing building codes. Land investors avoid all of that.

2. Your Leverage Comes From Information, Not Renovation

Flipping a house depends on upgrading the property.

Flipping land depends on unlocking value that other buyers missed:

- clearer zoning interpretation

- better comps

- improved listing strategy

- stronger marketing

- identifying development potential

This is why land flippers often double their profits by simply repositioning the parcel with the right buyer, rather than improving it physically.

3. Much Less Competition

Most real estate investors chase houses because it’s what they know.

But land investing remains one of the few niches where:

- Fewer offers come in

- Sellers are more flexible

- Seller financing is common

- You can negotiate much lower prices

The result?

Higher margins and faster closings.

4. Lower Risk & Lower Holding Costs

No tenants.

No maintenance.

No property damage.

And property taxes on vacant land are a fraction of what you’d pay on developed property.

Land flippers control their timeline without the stress of ongoing repairs, a key factor for both new investors and full-time flippers, building a predictable pipeline of land deals.

5. Wider Buyer Pool

A vacant piece of land appeals to different types of potential buyers:

- First-time homebuyers wanting affordable lots

- Builders needing new inventory

- Long-term investors

- Commercial developers

- Recreational users

That diversity keeps deals moving even when the real estate market shifts.

Steps to Start Land Flipping as a New Investor in 2026

Getting started with land flipping in 2026 comes down to one thing: knowing how to evaluate vacant land, spot undervalued land deals, and move quickly before other real estate investors notice the opportunity. Here’s the exact sequence new land flippers follow inside our system.

1. Do Thorough Market Research & Verify Zoning Regulations

Before buying land, especially undeveloped land, confirm that the parcel supports your exit strategy.

Key checks that matter in 2026:

- Review market trends, land prices, and population growth to see where demand is actually increasing.

- Verify zoning laws and zoning regulations directly with the county, not the listing.

- Pull environmental data to rule out flood zones, wetlands, or restrictions that could stall resale.

- Compare the parcel’s market value with nearby vacant land sales so you know the real spread between the buying price and potential resale value.

Smart flippers don’t gamble; they buy only when due diligence confirms strong margin potential.

2. Explore Financing Options That Fit Your Business Model

You don’t need deep pockets to start flipping land. You just need the right financing options for the deal type.

Most common structures for 2026:

- Seller financing or owner financing for low upfront capital and flexible terms.

- A bank loan or a private lender when you want speed for competitive offers.

- Budgeting for the non-negotiables: closing costs, monthly payments, and property taxes.

3. Use Reliable Tools & Strategies to Evaluate and Sell Parcels

Land flipping isn’t about luck; it’s about systems.

Essential tools for new flippers:

- Online real estate platforms, county GIS, and land-specific listing services to pull comps and verify land value.

- Simple marketing strategies that put your listing in front of the exact potential buyers your parcel attracts.

- Accurate phone numbers, clean maps, and property data inside your listings are small details that increase buyer trust and boost sale price.

Reducing holding costs, identifying parcels with strong development potential, and selecting land with clear business-use options all drive higher profit margins.

Exploring Financing Options for Land Deals

When you’re flipping land in 2026, your financing options decide how fast you can move, how strong your offer looks, and how much profit margin you keep. Flipping land isn’t like buying rentals or traditional real estate investing; your goal is to control a piece of land with the least friction, the lowest holding costs, and the most flexible repayment structure.

Here’s the clearest breakdown for new land flippers, real estate investors, and anyone stepping into the land investing space:

1. Seller Financing & Owner Financing (Most Flexible for New Investors)

This is the easiest on-ramp for buying land when you don’t want bank paperwork or higher interest rates.

- Negotiated directly with the landowner

- Lower down payments

- Custom monthly payments based on your planned exit

- Ideal when flipping land with a quick turnaround

Many land deals inside our coaching program are closed this way because it keeps cash flow manageable while giving you control of the parcel immediately.

Best for:

- New investors with limited capital

- Off-market deals where sellers want a fast, clean offer

- Short-term holds before resale at a higher price

2. Bank Loans & Private Lenders

If the seller refuses terms, a bank loan or private lender can fill the gap, but with different expectations.

Bank Loans:

- Lower interest rates than hard money

- Higher documentation requirements

- Best for parcels with clear zoning and strong market value

Private Lenders:

- Faster approvals

- Higher interest rates but fewer restrictions

- Useful when timing matters more than cost

In 2026, private lenders are becoming a go-to for real estate investors flipping land in competitive counties.

3. Budgeting for Holding Costs & Upfront Expenses

Every land investment has quiet expenses that eat into your spread if you’re not tracking them:

- Property taxes

- Closing costs

- Basic due diligence (survey, environmental checks, zoning confirmation)

- Marketing costs when you relist the land

Holding costs matter more in land flipping than house flipping, because your goal is to keep them as close to zero as possible.

If you can safely hold a parcel for 60–120 days without financial pressure, you’ve set yourself up for a successful flip.

4. Match Financing to the Deal, Not the Other Way Around

The biggest mistake new investors make is choosing financing before they understand the deal.

Here’s the rule we use in The Land Method:

- Quick flip?

→ Seller financing or private money = fastest exit, fastest ROI - Bigger parcel with development potential?

→ Bank loan = lower long-term costs - Low price, off-market deals?

→ Owner financing keeps cash in your pocket for the next opportunity

Financing isn’t just about getting the deal done; it’s a strategic part of increasing land value, maximizing return, and keeping your cash flow predictable while you scale.

Strategies to Attract the Right Buyer

Attracting the right buyer for a vacant land flip isn’t about posting a listing and hoping for the best; it’s about positioning the parcel clearly so serious real estate investors, first-time homebuyers, or builders immediately understand its value and potential uses.

1. Lead With What the Land Can Become

Buyers respond to the possibility. Highlight development potential, nearby infrastructure projects, zoning perks, or the ability to add value through basic improvements. A good listing makes it easy for potential buyers to picture the land as a future homesite, small rental build, or long-term land investment.

2. Use Targeted Marketing, Not Generic Ads

Your buyer pool is niche. Market directly where motivated land buyers actually look:

- Specialized online listings for vacant land

- Facebook groups for land flippers and local investors

- Direct outreach to builders, tiny-home developers, and mobile-home retailers

The more specific your outreach, the faster you find a buyer willing to pay the higher price your upgrade created.

3. Package the Deal With Clean, Useful Data

Land buyers hate uncertainty. Remove it by providing a complete info packet:

- zoning regulations summary

- property lines, parcel map, and GPS pins

- soil notes, setbacks, and any environmental issues already checked

- recent market value comps

This reduces back-and-forth and helps you stand out in a space where most sellers offer very little detail.

4. Match Your Message to the Buyer Type

Different buyers care about different benefits:

- First-time homebuyer: affordability, flexible seller financing, quiet setting

- Savvy investors: strong resale potential, low holding costs, high-velocity markets

- Builders: clean access, clear zoning, fast permitting

Dial in the pitch and the right buyer shows up quickly.

5. Create a Sense of Movement, Not Desperation

Land buyers respond well to momentum. Show nearby sales, current market trends, or recent off-market deals you closed. This positions your listing as a real opportunity, not another stagnant land ad.

<This can be in an image format where we can show how profit was made-by the client>

Case Studies of Successful Land Flipping

Is Raw Land Flipping the Best Real Estate Strategy for 2026?

Raw land flipping continues to stand out going into 2026 because it offers something most real estate investment strategies don’t: low acquisition costs, minimal risk, and the ability to create value without construction or renovations. But the real advantage comes when you understand how to evaluate, price, and position a parcel of vacant land to maximize spread, something we specialize in at The Land Method.

Here’s what sets our approach apart:

Why Our System Works?

We built our entire land-flipping framework from the deals we close every week, not theory, not recycled strategies, and not outdated tactics you’ll find in generic programs. Every workflow, valuation filter, and negotiation template inside our training reflects what we actually use to flip land profitably across the United States.

Meet the Founders Behind the System

Ginis Garcia — Systems, Data, & Acquisition Strategy

Ginis is known for engineering the operational side of land flipping.

He teaches students:

- How to pull county-level data

- How to skip-trace owners efficiently

- How to identify undervalued vacant land before it hits the market

- How to negotiate using structured offer tiers

His strength is simplifying complex due diligence so new investors, and even seasoned real estate investors, can make clear, data-backed decisions.

Jonathan Haveles — Deal Flow, Pricing, & Exit Strategy

Jonathan has flipped land for two decades and brings real-world pricing logic to the table.

He trains students on:

- How to analyze market value trends

- How to price land to sell fast without leaving profit on the table

- How to structure seller financing for recurring cash flow

- How to select the right exit strategy based on the parcel and local market

Jonathan is also one of the hosts of our Crushing Land series, where he breaks down real deals from students every week so you can learn directly from active transactions.

Why Students Trust The Land Method for Land Flipping?

- The Land Riches Blueprint: Coaching Edition is updated frequently, sometimes quarterly, to keep up with changing zoning laws, market conditions, interest rates, and land-use regulations.

- You get every document we use, including contracts, offer templates, marketing scripts, and due diligence checklists.

- We provide real support; you’re not left alone after watching the modules. Students get coaching calls, deal reviews, and direct help for structuring profitable flips.

- You don’t have to be in the U.S. to flip land. Many of our students operate remotely from outside the country using our title company network and systems.

FAQs

1. Do I need real estate experience to start land flipping?

No. Many of our most successful students started with zero background in real estate. Inside The Land Method, we walk you through every step, from zoning and due diligence to negotiating with sellers and closing profitable land deals.

2. How much money do I need to begin flipping land?

Not as much as traditional real estate. Because vacant land has lower acquisition costs, many students start with $3,000–$10,000 or even less using seller financing. We also show multiple entry strategies that require little upfront capital.

3. How does The Land Method help me avoid bad land deals?

We give you our full due diligence system, the same one Ginis and Jonathan use in their own business: zoning checks, market data templates, red-flag lists, valuation frameworks, and recorded deal reviews so you can avoid parcels with title issues, environmental problems, or unrealistic resale value.

Ginis Garcia is a seasoned real estate investor with over 14 years of experience helping both new and experienced investors achieve their goals in the housing and land markets.

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia

- Ginis Garcia